The Effects Of Inflation On Your Retirement

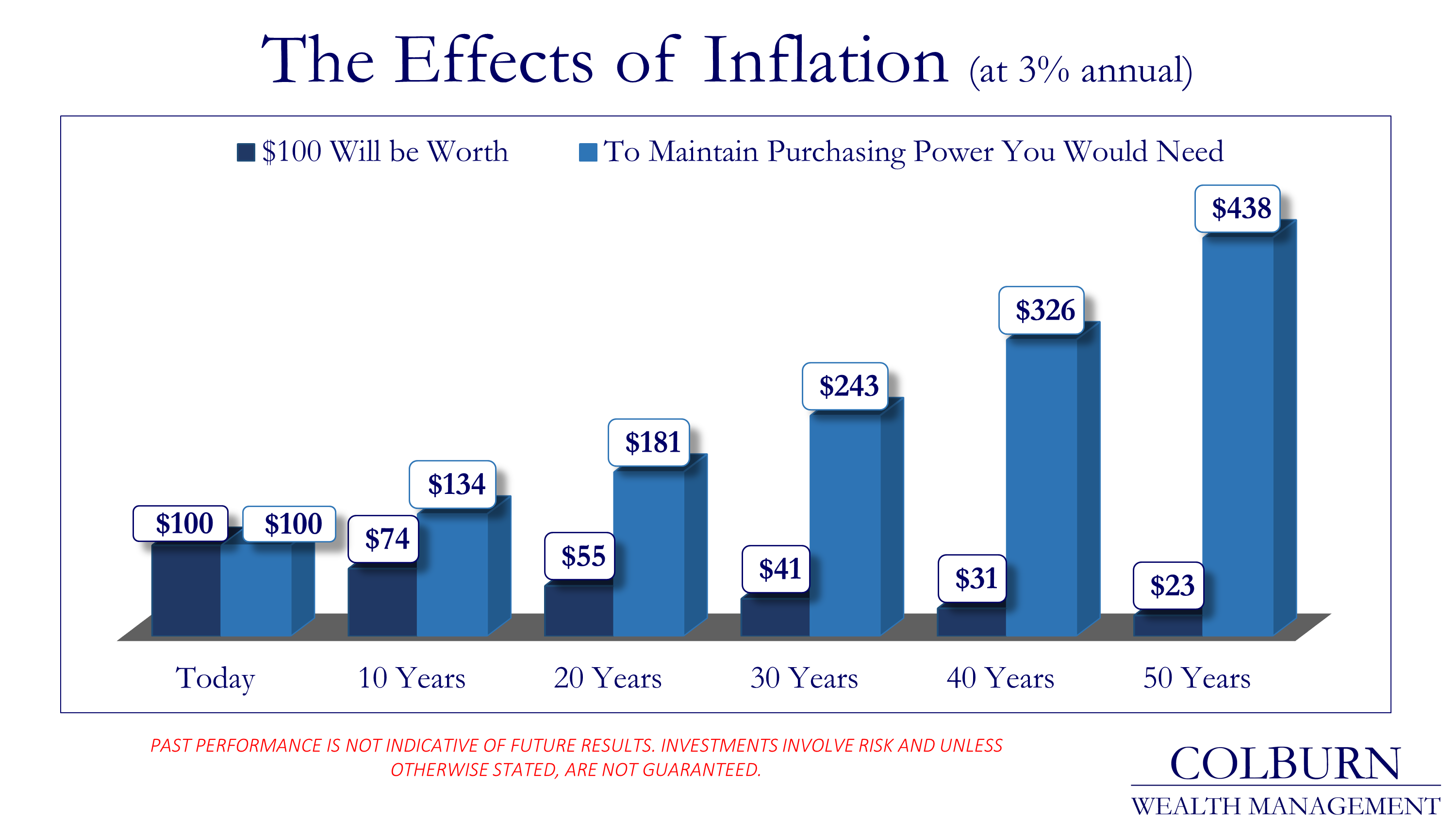

In retirement planning, one of the largest factors is the long-term effect of inflation. Though there are some items, such as electronics, that often stay the same price or even get cheaper over time, most products we use on a day to day basis become more expensive. In the slower growth economic environment we currently find ourselves in, inflation has been running a bit lower, but historically has averaged roughly 3% annually. While $100 of products or services costing an extra $3 one year later may not seem like a big deal, it can make a tremendous difference in the longer-term as illustrated by the chart below.

There are a couple different ways to assess the effects of inflation. One is to look at how much money would be needed to maintain $100 of purchasing power for different lengths of time as illustrated in the light blue bars. In our example above, 1 year later $103 are required to buy $100 of goods and services. 30 years later, however, at 3% inflation, $243 would be required to pay for the same $100 worth of goods and services! Quite a difference.

The other way to look at inflation is to flip it on its head and see how much goods and services one could buy if they simply retained $100 cash in a jar; opened it up a decade or two later and went to the store. What would that $100 put in a jar now buy 30 years down the road…only an estimated $41 of goods and services!

may be reached at

740-831-4004and

info@colburnwm.com