Cardinal Stock: Navigating Recency Bias in Your Portfolio Strategy

One of the more subtle behavioral traps in personal finance is recency bias—the tendency to give disproportionate weight to recent events when making decisions. It’s a bias that shows up everywhere: in how we invest, how we plan, and even how we perceive risk.

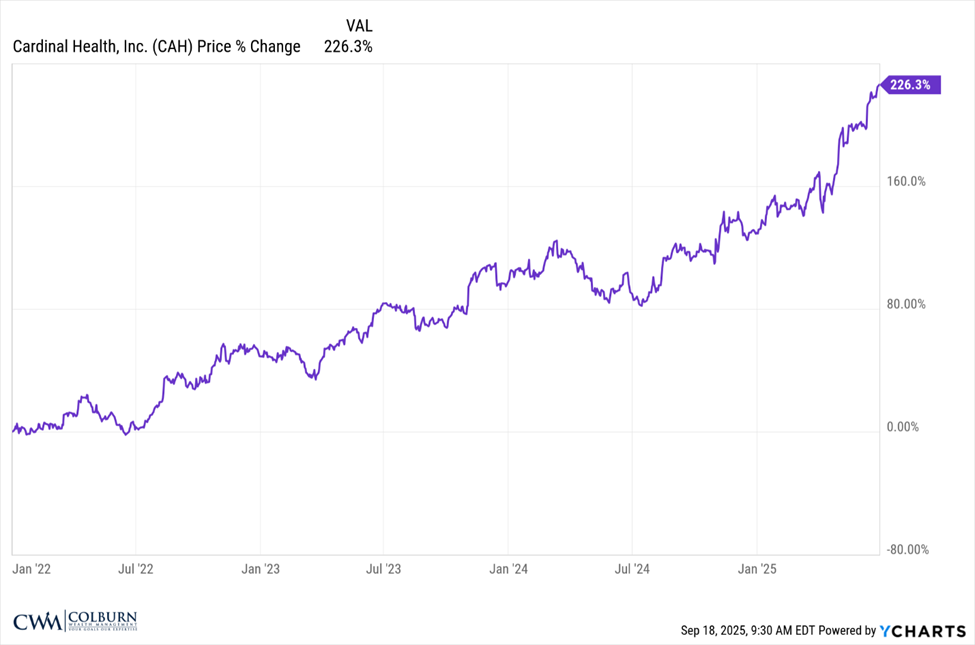

As of late, it’s been especially relevant for Cardinal Health stock. From 2022 through June of this year, Cardinal Health stock delivered an impressive run.

That kind of performance can feel validating—especially for employees who hold shares. But it can also lead to a subtle shift in thinking:

“Cardinal stock has been great to me lately… maybe I should hold onto more of it.”

That’s recency bias in action. It’s the mental shortcut that assumes what’s happened recently will continue happening. And while it’s understandable, it can also lead to portfolio drift and overconcentration—holding more company stock than is typically prudent for a diversified financial plan.

As Morningstar’s Amy Arnott puts it, “Recency bias is the tendency to place too much weight on the latest performance trends while giving short shrift to other factors, such as fundamentals, valuation, or long-term market averages”. It’s a cognitive shortcut that can feel rational in the moment—but often leads us away from sound strategy.

And while it’s natural to feel optimistic about a company you know well and work for, it’s important to separate confidence in the business from discipline in your portfolio.

This same bias can show up in other parts of your portfolio as well. For example, investors might overweight sectors like technology simply because they’ve performed well recently—without considering whether those allocations still align with their long-term goals or risk tolerance. Recency bias doesn’t just affect how we view individual stocks; it can shape our entire investment strategy if we’re not careful.

Even within diversified portfolios, it’s common to see investors chase recent winners—mutual funds or ETFs that have outperformed over the past year—while ignoring broader fundamentals. That’s why periodic rebalancing and a rules-based approach are so important. They help ensure your portfolio reflects your plan, not just your memory of what’s been working lately.

Three Ways to Counter Recency Bias

- Zoom Out

Instead of focusing on the last 6–18 months, look at longer-term performance and volatility. - Revisit Your Allocation Strategy

How much company stock do you currently hold relative to your overall portfolio? If it’s more than 10%, it might be time to rebalance. And what about recently hot sectors—like technology? If your portfolio has tilted heavily toward recent winners, you may be carrying more risk than is appropriate for your long-term goals or risk tolerance. - Use a Rule-Based Approach

Consider setting a rule for how you handle vested RSUs or any concentrated stock positions—whether they’re tied to Cardinal or other holdings that have recently performed well. For example: “I’ll sell 50% of vested shares each year and reinvest in a diversified portfolio.” Rules like this help remove emotion from the equation and protect against the temptation to chase recent winners or hold too tightly to familiar names.

As Omar Aguilar of Schwab Asset Management notes, “Recency bias is a powerful cognitive bias that may lead us to make investment decisions that are based on recent conditions that we extrapolate into the future.” That’s why rules-based strategies and long-term discipline are so important.

The Takeaway

Recency bias is sneaky. It shows up when things are going well—when optimism is high and discipline feels unnecessary. But the best financial decisions are made with a long-term lens, not a short-term memory.

If you’re holding more Cardinal stock than you intended—or if recent performance has made you rethink your strategy—it might be time to pause, zoom out, and revisit your plan.

The same goes for any investment that’s recently surged. Whether it’s a sector fund, a tech-heavy ETF, or a stock that’s been on a hot streak, it’s worth asking: Is this allocation still aligned with your long-term goals? Recency bias can quietly shift your portfolio away from balance—especially when optimism is high and discipline feels optional.

As always, stay the course. And if you’d like help reviewing your allocation or building a rules-based strategy, I’d be happy to talk.

Colburn Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.