How to Navigate Fears of a Market Bubble

With markets hitting new highs and AI stocks surging, it’s natural to wonder: Are we in a bubble? That question is as much about psychology as it is about fundamentals. And while it’s reasonable to be cautious, obsessing over bubbles can lead to short-term decisions that derail long-term plans.

The term “bubble” gets tossed around often, but it’s hard to define. Markets move in cycles, and sentiment shifts with them. For every true bubble—like the dot-com era or housing boom—there are many false alarms. After 2008, investors braced for more bubbles, only to witness the longest bull market in history.

What matters most is staying aligned with your plan.

When people talk bubbles, they’re usually reacting to price. But price alone doesn’t tell the full story. What matters is value—what you’re getting for your money. Stocks represent ownership in businesses and their future cash flows. Metrics like price-to-earnings help us understand not just what we’re paying, but what we’re buying.

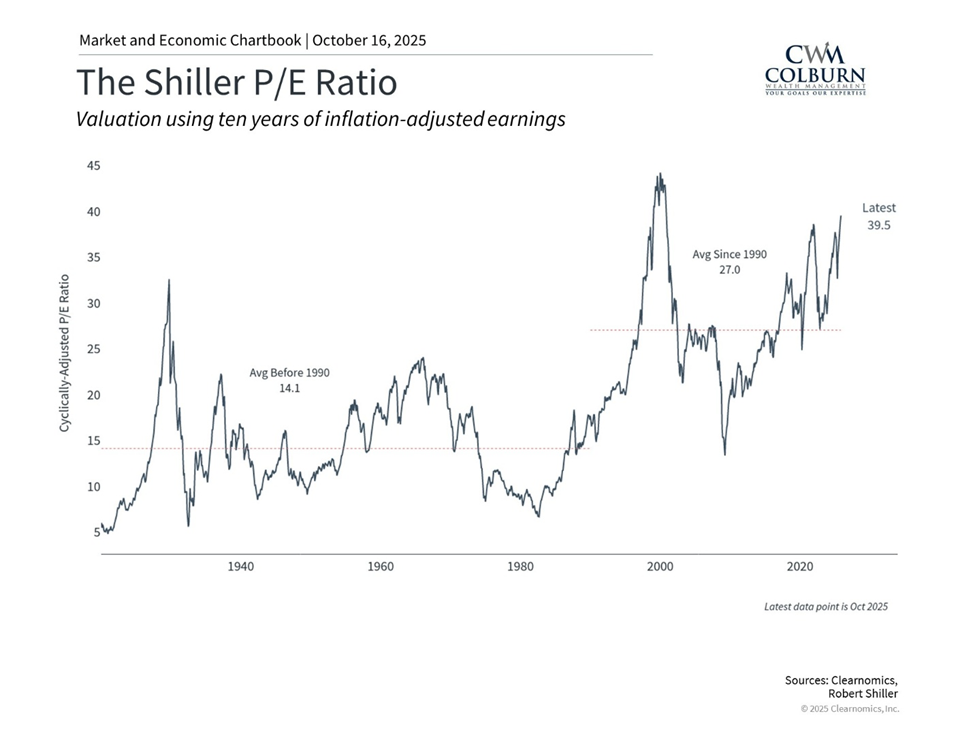

Take the Shiller P/E ratio, which smooths earnings over a decade and adjusts for inflation. Today’s level of ~38x is well above the historical average of 27x. That’s elevated—but not unprecedented. It reflects a market navigating inflation, policy shifts, and excitement around transformative tech like AI.

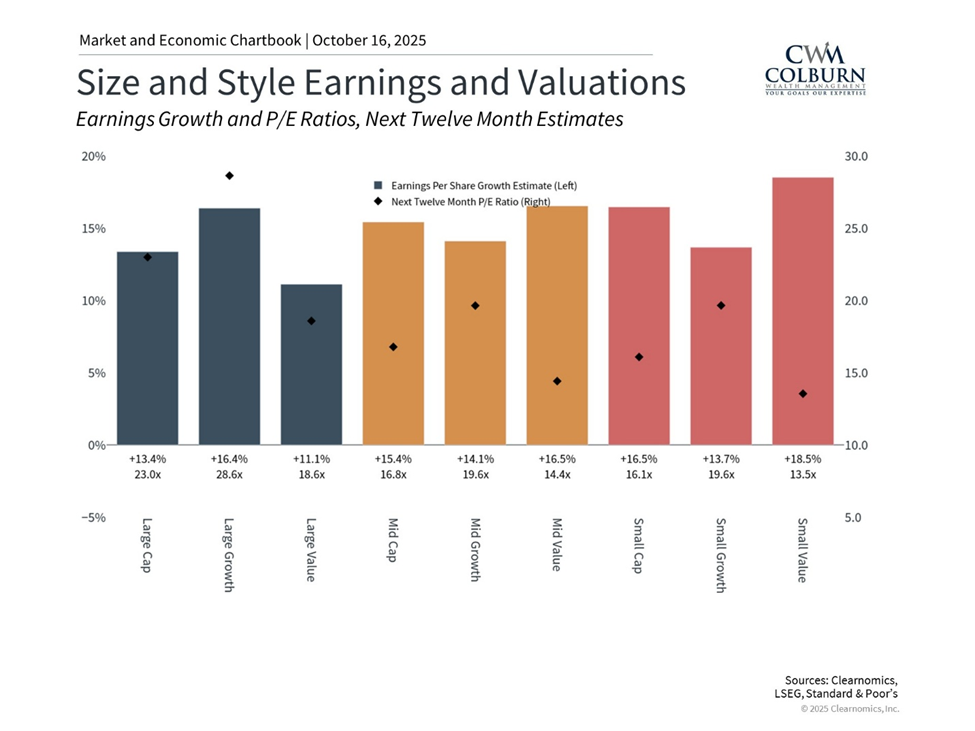

While large-cap growth stocks carry the highest valuations, other areas look more attractive. Large value and small caps, for example, offer healthier valuation profiles with solid earnings growth.

Holding a mix of styles, sizes, and sectors helps manage risk and improve your portfolio’s valuation profile. It’s hard to predict what leads next—but diversification gives you exposure without overcommitting to any single theme.

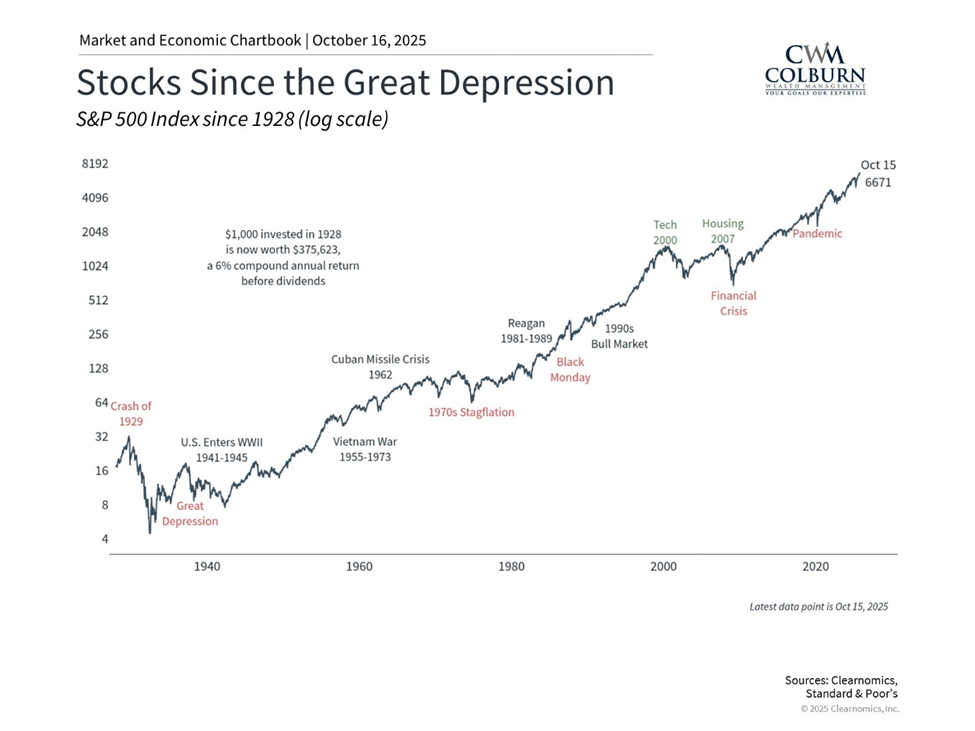

History shows that time rewards patience—even during periods of high valuations. Zoom out, and even dramatic events like the dot-com crash or housing crisis look like blips. Investors who stayed the course were rewarded.

That’s why strategies like dollar cost averaging and periodic rebalancing matter. Even those who invested at the worst possible moments—like the 1929 peak—eventually saw positive returns. Starting at lower valuations helps, but over long horizons, discipline matters more than timing.

Yes, valuations are high. But they’re high for a reason: strong earnings and resilient business fundamentals. Rather than guessing what happens next, focus on building a portfolio that can grow while managing risk—especially if you’re holding concentrated positions in Cardinal stock or other recent winners.

If you’d like help reviewing your allocation or building a long-term strategy, I’d be happy to talk.

Take care—and as always, stay the course.