HSA vs. FSA: How We Help Clients Think Through Healthcare Elections

During healthcare election season, many Cardinal Health employees face a familiar decision: choosing between a high-deductible health plan (HDHP) with a Health Savings Account (HSA), or a traditional PPO plan with a Flexible Spending Account (FSA). Both offer tax advantages—but they serve different purposes, and the right fit depends on how you use healthcare, save, and plan for the future.

Here’s how we help clients think through it.

Understanding the Basics

- HSA plans pair with HDHPs. You’ll pay lower premiums but higher deductibles. In return, you gain access to an HSA—a triple-tax-advantaged account that lets you save, invest, and withdraw for qualified medical expenses tax-free.

- FSA plans pair with PPOs. You’ll pay higher premiums but lower deductibles. FSAs also offer tax-free savings, but they’re use-it-or-lose-it and can’t be invested.

What We Ask Clients to Consider

1. Are you planning for today—or for decades ahead?

FSAs are great for budgeting known, near-term expenses. But HSAs reward long-term planning. Funds roll over annually, can be invested, and—even if used decades from now—retain their tax-free status for qualified medical costs.

2. How predictable are your healthcare costs?

If you expect regular doctor visits, prescriptions, or procedures, the PPO/FSA combo may offer more cost certainty. But if your usage is low or variable, the HDHP/HSA route may save you money over time—especially if you can afford to contribute and let the HSA grow.

3. Do you value flexibility and ownership?

HSAs are individually owned and portable. They stay with you if you change jobs or retire. FSAs are employer-owned and expire annually. That difference matters more than most people realize.

4. Are you in a high income tax bracket?

For clients with high incomes, we often recommend pairing an HDHP with HSA contributions. It’s a way to reduce taxable income while building a reserve for future healthcare costs.

5. Are you comfortable with behavioral trade-offs?

FSAs require precise budgeting to avoid forfeiting unused funds. HSAs, on the other hand, reward discipline and patience. But they also require comfort with higher deductibles and the ability to self-fund early expenses.

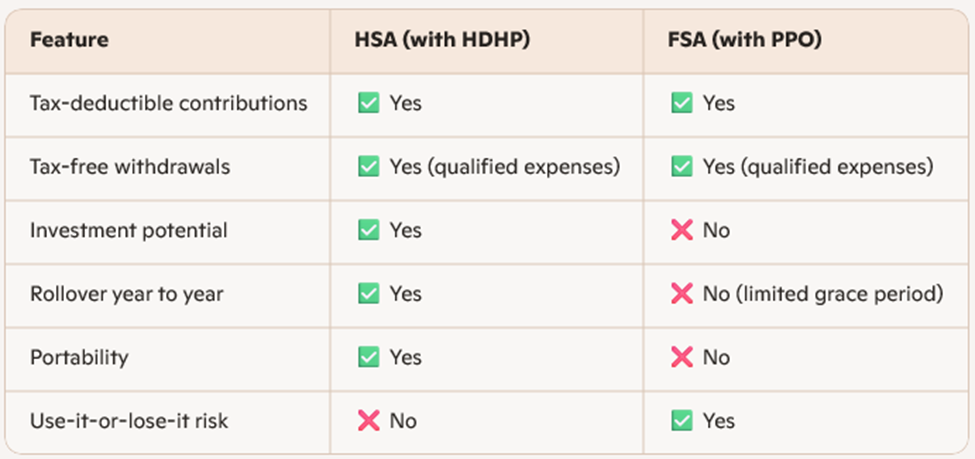

A Quick Comparison

Maximizing Your HSA: A Long-Term Strategy

If you’re enrolled in an HSA and have financial flexibility, consider not using it for current out-of-pocket healthcare expenses. Instead, pay those costs from your regular cash flow and let your HSA continue to grow. Since HSA funds compound tax-free and can be used for qualified medical expenses in retirement, this strategy turns today’s savings into tomorrow’s healthcare safety net.

Final Thought

There’s no one-size-fits-all answer—but there is a right fit for your situation. Whether you’re optimizing for cash flow, tax efficiency, or long-term planning, understanding the trade-offs between HSA and FSA plans can help you make a confident choice this election season.

Take care and, as always, stay the course.

Colburn Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.