Quick Summary of Cardinal’s Q2 FY26 Results

This week, we’re stepping away from our usual personal finance tips to take a brief look at Cardinal Health’s latest earnings release.

As employees, you naturally have access to insights that go well beyond what’s shared publicly. Still, an outside perspective on the publicly available information can be useful—especially if you haven’t had a chance to dig into the earnings release yourself.

While there’s no substitute for listening to the earnings calls and exploring the resources available to you as employees, I hope this brief overview offers helpful context for those who haven’t had the time.

Quick Earnings Summary

Cardinal Health reported another strong quarter, with revenue up 19% to $65.6 billion and non‑GAAP EPS up 36% to $2.63. Operating earnings grew 29% on a GAAP basis and 38% on a non‑GAAP basis, reflecting broad‑based strength across all five operating segments. The company raised full‑year EPS guidance to $10.15–$10.35 and updated segment‑level profit expectations across the enterprise.

Pharmaceutical and Specialty Solutions continued to lead performance, with 19% revenue growth and 29% profit growth, driven by strong demand across brand and specialty categories, contributions from MSO platform acquisitions, and positive generics program performance.

Initial Market Reaction

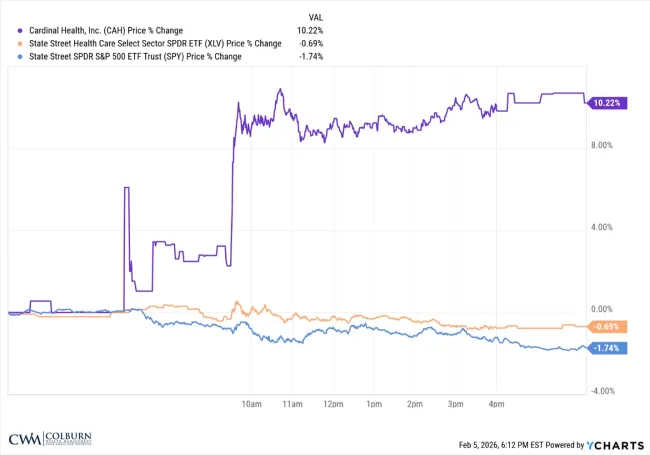

Once again, the market appreciated the earnings release and management commentary, with the stock popping more than 10% on the day (including after‑hours trading). That strength is even more notable given that both the broader market and the healthcare sector finished the day in the red:

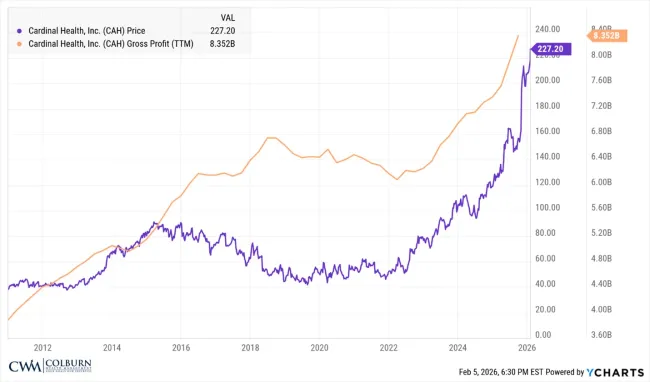

Taking a step back, the 10-year chart shows the stock well off the 2020 lows and nearly triple the 10-year average price of $78.60:

Inside the Q&A: Management’s Perspective

During the Q2 earnings call, Cardinal Health’s executive team addressed analyst questions on specialty momentum, capital allocation, GMPD progress, and long‑term strategy. Here’s what stood out:

On Specialty Strength and What’s Driving Pharma Growth

Analysts asked for more detail on the components of Pharma segment performance and how much was organic versus acquisition‑driven. CFO Aaron Alt highlighted broad-based demand across brand, specialty, consumer, and generics, with specialty continuing to outperform expectations. He noted strong trends in urology, oncology, and biopharma services, and emphasized that MSO contributions were consistent with expectations, meaning the quarter’s strength was largely organic.

On Capital Allocation and M&A Discipline

With leverage back within the targeted range and strong cash generation, analysts asked about Cardinal’s capacity for additional transactions. Alt reiterated the company’s disciplined approach, noting that baseline share repurchases for the year are already complete. CEO Jason Hollar added that while Cardinal remains “opportunistic,” the strategy is not dependent on large M&A, and the focus remains on strengthening the core businesses.

On the Specialty Flywheel and Long‑Term Strategy

Analysts asked how recent specialty success influences future investment priorities. Hollar reaffirmed the company’s “specialty flywheel” — the combination of distribution, MSOs, biopharma services, and customer relationships — as a key strategic advantage. He emphasized that there is still “more than enough opportunity” within existing platforms, reducing the need to expand into unrelated areas.

On GMPD Progress and Cardinal Health Brand Growth

Questions around GMPD centered on accelerating Cardinal Health brand performance and SG&A efficiencies. Hollar credited years of investment in the GMPD 5‑point plan, noting that “backorders have never been lower” and service levels are at record highs. Alt added that GMPD has been “relentless” in optimizing its cost structure while improving customer service.

On Pricing, Policy, and the Macro Environment

Analysts asked about brand drug pricing trends and potential impacts from policy changes. Hollar reiterated that while pricing adjustments can affect revenue optics, Cardinal has aligned cost structures and manufacturer agreements to preserve margins. He also noted that GLP‑1 volume growth remains significant but is not a major driver of profitability, consistent with prior quarters.

On Biopharma Services and Sonexus Momentum

Analysts asked about competitive wins and future investment needs in Sonexus. Hollar highlighted the team’s customer‑centric approach and the success of its digitized platform, which makes it easier for manufacturers to scale multiple therapies. Alt reiterated the company’s goal of reaching $1 billion in biopharma services revenue by FY28, with Sonexus driving roughly half of that growth.

The Longer View

While no single chart can fully explain a company’s stock performance—especially one as multifaceted as Cardinal Health—the long‑term trend is hard to ignore. Much of the stock’s sustained strength aligns with the steady growth of gross profits over time:

What This Means for You

Stronger Results Reinforce Long‑Term Value

With revenue, earnings, and guidance all moving higher, the company’s financial momentum supports long‑term share value — especially relevant for those holding RSUs or planning around equity compensation.

Execution Across All Segments Builds Stability

From Pharmaceutical & Specialty Solutions to GMPD and at‑Home Solutions, broad‑based profit growth signals operational discipline and a more resilient business.

Capital Allocation Remains Shareholder‑Friendly

Ongoing buybacks and disciplined investment — including MSO platform expansion — reflect management’s confidence in the company’s trajectory and long‑term strategy.

Staying Informed Helps You Plan Ahead

Understanding where the company is headed can help you make better decisions about retirement planning, equity comp, and your broader financial strategy.

We’ll return to our usual financial tips next week.

Take care and, as always, stay the course.

Colburn Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.