Shutdowns Make Headlines—Not Market History

Washington is back in the headlines as the federal government enters a shutdown following a lapse in funding legislation. With no new agreement reached, many federal services have already begun to scale back or pause operations. This development adds to a year marked by policy shifts around trade, taxes, and immigration—each contributing to a broader sense of economic uncertainty.

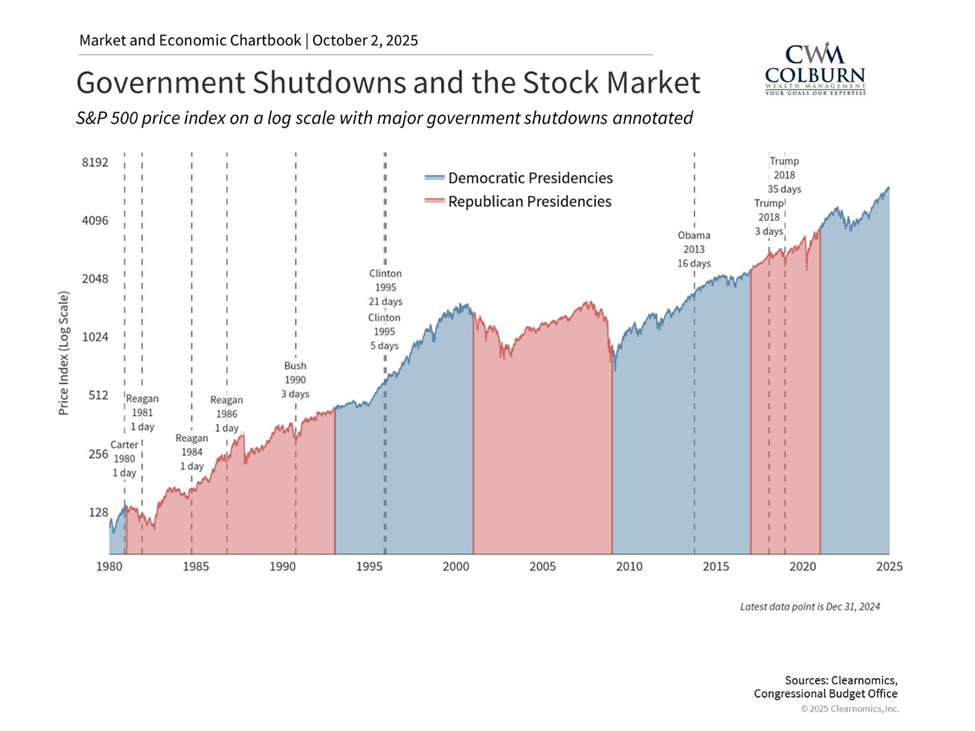

For investors, it’s natural to wonder how political gridlock might affect their portfolios, especially amid concerns about the growing budget deficit and national debt. But history offers a reassuring perspective: markets tend to look past the drama.

Shutdowns Make Headlines—Not Market History

Government shutdowns can be disruptive for federal workers and agencies, but their impact on financial markets has historically been minimal. For long-term investors, these episodes are a reminder to separate political views from financial plans. That’s especially important when headlines focus on controversial topics that rarely affect portfolio fundamentals.

Each year, Congress must pass a budget for the fiscal year beginning October 1. While the “One Big Beautiful Bill Act” earlier this year outlined tax and spending priorities, lawmakers still need to allocate funds across departments. Without agreement, the government entered a shutdown—bringing furloughs and service delays.

This isn’t new. Over the past five decades, Congress has rarely passed budget bills on time. Instead, last-minute negotiations and temporary funding measures—known as continuing resolutions—have become the norm.

Shutdowns have occurred under presidents of both parties, from Reagan to Clinton, Obama, and Trump. Even the longest shutdown on record in 2018–2019 had little lasting effect on markets. As the chart below highlights, investors have consistently looked past these disruptions, focusing instead on broader economic trends.

What’s Different This Time?

While the immediate debate centers on healthcare spending, the deeper issue is fiscal discipline. With federal debt now around 120% of GDP, there’s largely agreement on the need for restraint—but little consensus on how to achieve it.

What’s unique about this moment is the administration’s intent to potentially pursue permanent workforce reductions. Unlike typical furloughs, this could have longer-term implications for employment and spending. Still, furloughed workers are expected to receive back pay once the shutdown ends, as they did in 2019.

Markets Care About Fundamentals, Not Headlines

Despite the noise, markets remain focused on fundamentals. Shutdowns don’t alter corporate earnings, consumer behavior, or long-term growth prospects. They may delay economic data releases—like jobs reports or inflation figures—but these are temporary setbacks.

If shutdowns persist, they can create modest headwinds as federal workers reduce spending and services are paused. But even extended disruptions have not historically derailed market performance.

The Bottom Line

Government shutdowns may dominate headlines, disrupt services, and create stress for federal employees—but they’ve rarely rattled markets. For investors, the best response is to stay grounded in long-term financial plans and avoid reacting to short-term political theater.

Take care and, as always, stay the course.

Colburn Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.