Quick Summary of Cardinal Q1 FY2026 Earnings and Management Commentary

This week, we’re stepping away from our usual personal finance tips to take a brief look at Cardinal Health’s latest earnings release.

As employees, you naturally have access to insights that go well beyond what’s shared publicly. Still, an outside perspective on the publicly available information can be useful—especially if you haven’t had a chance to dig into the earnings release yourself.

While there’s no substitute for listening to the earnings calls and exploring the resources available to you as employees, I hope this brief overview offers helpful context for those who haven’t had the time.

Quick Earnings Summary

Cardinal Health reported a very strong start to fiscal year 2026, with revenue up 22% to $64 billion and EPS up 36% to $2.55. Operating earnings grew 37%, driven by broad-based strength across all five operating segments. The company raised full-year EPS guidance to $9.65–$9.85 and increased its adjusted free cash flow outlook to $3.0–$3.5 billion.

Pharmaceutical and Specialty Solutions led the way, with 23% revenue growth and 26% profit growth. Growth was fueled by strong demand across branded, specialty, generics, and consumer health categories, as well as contributions from MSO platforms and recent acquisitions.

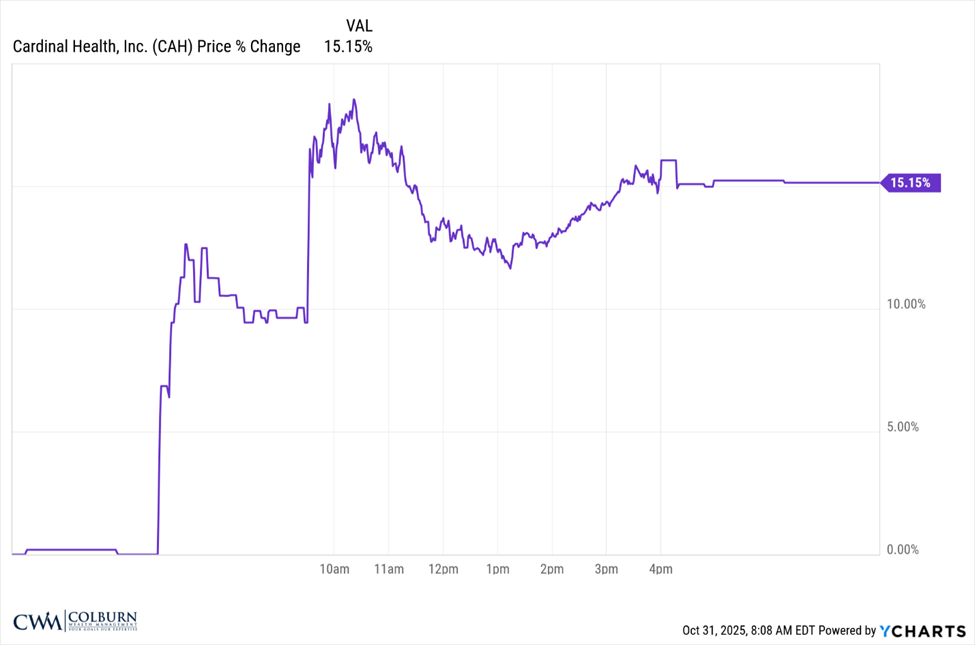

Initial Market Reaction

Clearly the market appreciated the earnings release and management commentary with the stock popping more than 15% on the day:

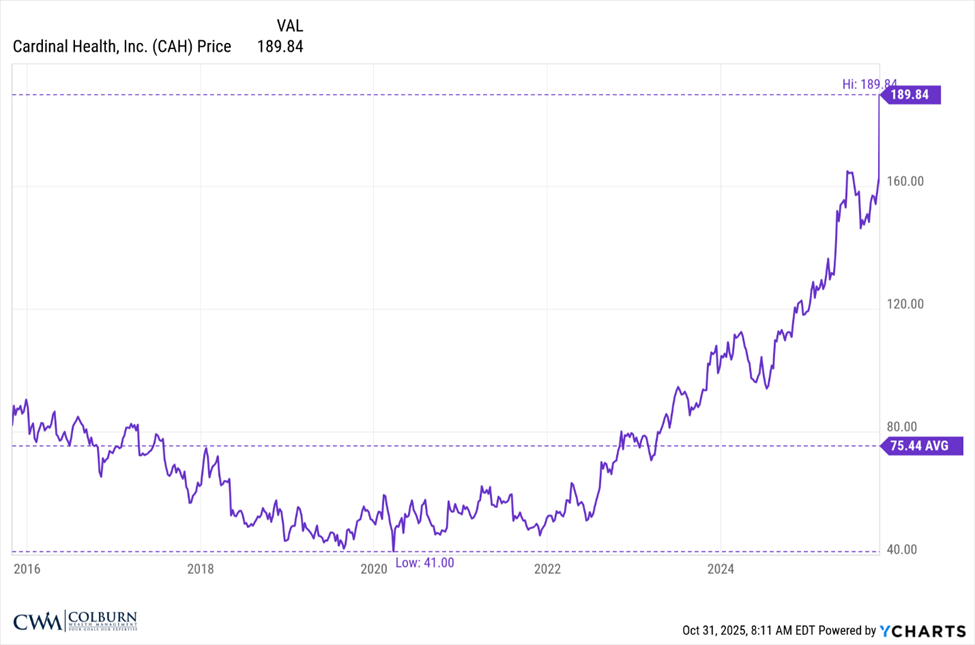

Taking a step back, the 10 year chart shows the stock well off the 2020 lows and more than double the 10 year average price of $75:

Inside the Q&A: Management’s Perspective

During the Q1 earnings call, Cardinal Health’s executive team fielded questions from analysts focused on growth sustainability, integration progress, and strategic positioning. Here’s what stood out:

On Momentum and M&A Contribution

Analysts asked whether Cardinal’s strong Q1 performance was sustainable and how much of the upside was driven by acquisitions. CEO Jason Hollar pointed to “broad-based industry utilization trends that continue to be positive,” while CFO Aaron Alt noted that “the specialty business in Q1 was trending above historical levers and was a strong performer for us.” Management reiterated that M&A—including Solaris, ION, and GIA—is expected to contribute 8 percentage points to Pharma segment profit growth this year.

On Rite Aid Volume and Policy Impacts

Elizabeth Anderson of Evercore asked about the impact of Rite Aid’s restructuring. Hollar clarified that Cardinal did not previously support Rite Aid, but is now gaining share: “We started with 0%, and we’re now getting a portion of that.” He also addressed policy developments in Washington, expressing alignment with efforts to improve affordability and access, and noting that such changes could be neutral to positive for Cardinal’s utilization trends.

On Execution vs. Market Tailwinds

Michael Cherny of Leerink Partners asked how much of Cardinal’s growth was driven by internal execution versus favorable market conditions. Hollar responded, “We stay focused on what we can control, no doubt about it,” emphasizing Cardinal’s investments in infrastructure, automation, and service quality as key differentiators.

On Synergy Realization in “Other” Segment

Eric Percher of Nephron Research asked about early synergy realization from the ADSG acquisition. Alt confirmed that integration is progressing quickly, and Hollar added that “38% revenue growth in the quarter and the 60% segment profit growth… both the core as well as the acquisition are significant contributors.” The “Other” segment—comprising At-Home Solutions, Nuclear and Precision Health, and OptiFreight—continues to outperform expectations.

On Confidence in Guidance

George Hill of Deutsche Bank pressed on the sustainability of growth and cadence of M&A. Alt responded, “We are comfortable and confident in the momentum we’ve seen, comfortable and confident in the guidance that we’ve provided,” reinforcing management’s conviction in the updated FY2026 outlook.

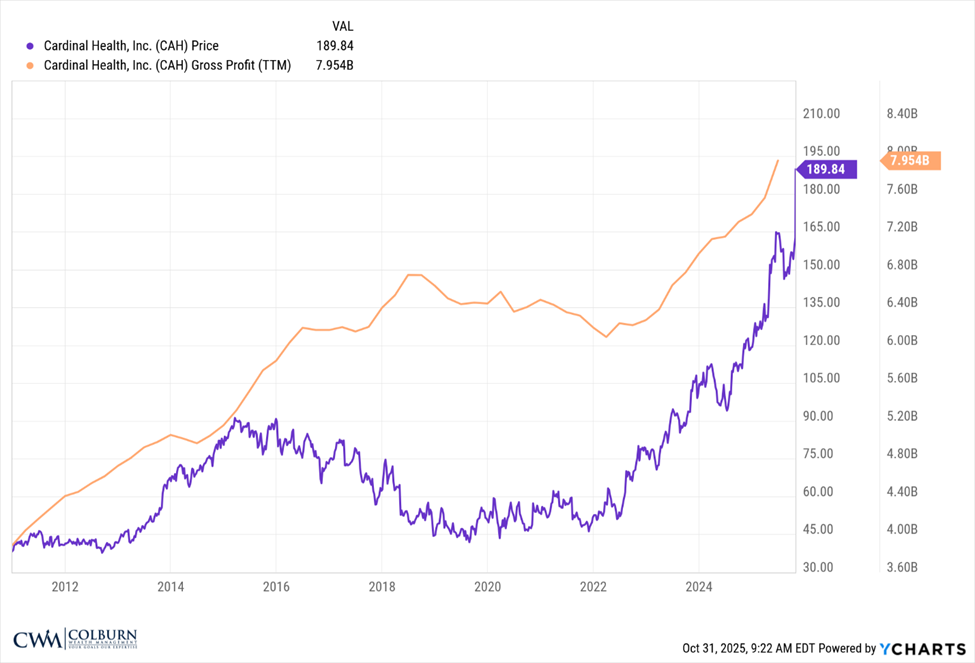

The Longer View

No single chart can fully explain a company’s stock performance—especially one as multifaceted as Cardinal Health. Still, it’s reasonable to argue that a key driver of the stock’s strong run has been the growth of gross profits over time:

What This Means for You

Stronger Financials = More Resilient Equity

Cardinal’s earnings growth and raised guidance may support long-term share value—important for those holding RSUs or planning around equity comp.

Operational Discipline Builds Confidence

From inventory management to segment profitability, Cardinal’s focus on execution supports long-term stability and growth.

Capital Returns Reflect Confidence

Dividend increases and share repurchases signal management’s belief in the company’s trajectory—and the value of your contributions.

Stay Informed, Stay Empowered

Understanding Cardinal’s financial direction helps you make smarter decisions—whether it’s planning for retirement, evaluating your equity comp, or simply staying engaged with the company’s mission.

We’ll return to our usual financial tips next week.

Take care and, as always, stay the course.

Colburn Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.