2026 Social Security COLA & What It Signals for Long-Term Planning

Whether retirement from is decades away or just around the corner, the financial decisions you make today will obviously shape your future. With inflation, interest rates, and longevity all evolving, it’s worth understanding how these forces impact long-term planning—and why portfolio construction matters at every stage.

Social Security COLA

The announced 2026 Social Security cost-of-living adjustment (COLA) is 2.8%, raising the average monthly benefit to $2,064:

While this may seem like a retiree-only headline, it’s also a reminder: inflation doesn’t stop when you retire—and your future income needs to keep up.

Consider how inflation has recently affected core expenses

• Medical care services rose 3.9% last year

• Health insurance: up 4.2%

• Home insurance: up 7.5%

• Meat, poultry, and fish: up 6.0%

• Full-service restaurants: up 4.2%

For those nearing retirement, COLA adjustments help offset rising costs—but they don’t cover everything. For younger employees, they’re a reminder to build portfolios that grow faster than inflation.

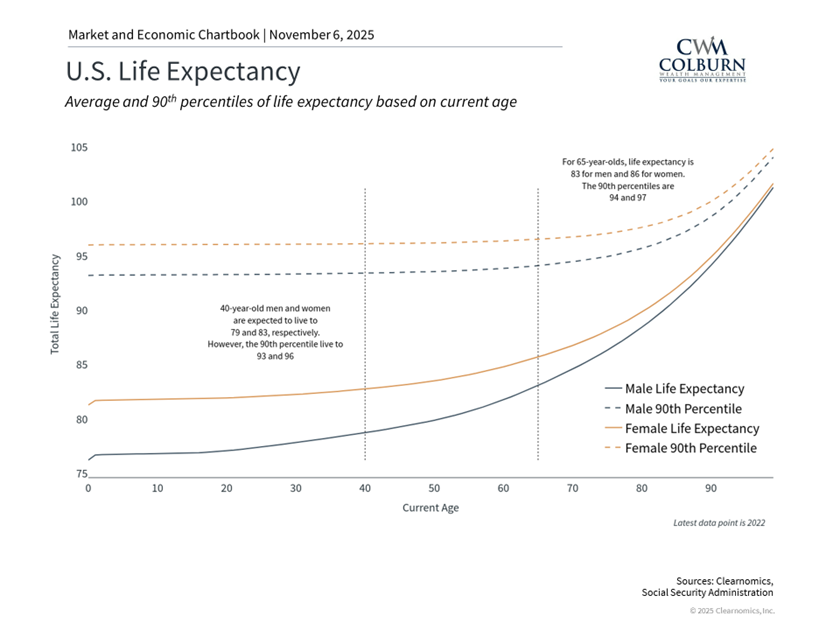

Longevity: A Planning Reality

Once you reach age 65, average life expectancy climbs to 83 for men and 86 for women—with many living well into their 90s.

That means your retirement savings may need to last 25–30 years or more. And that’s where portfolio construction becomes critical. While bonds generally offer income and stability, stocks play a key role in helping your money grow faster than inflation over the long haul.

As many of you know, if you’re earlier in your career and have decades to grow your investments, you’ll typically want to own more stocks to aggressively build wealth and outpace inflation. If, however, you are nearing retirement, stocks are still required for the inflation-beating growth you’ll need in retirement, but more attention should be given to building a balanced portfolio that also helps protect against large losses.

Final Thought

Whether you’re a year from your retirement or twenty-five, the fundamentals remain the same: inflation, longevity, and interest rates affect everyone. The earlier you plan, the more options you’ll have later—and the more confident you’ll feel when retirement gets closer.

Social Security will likely be part of your future, but it won’t be the whole picture. A thoughtful portfolio today can help you build toward the flexibility, independence, and peace of mind you’ll want tomorrow.

Take care and, as always, stay the course.

Colburn Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.