2026 Outlook: 7 Key Themes for Long-Term Investors

We haven’t revisited investment markets in a while, and with the new year approaching, it’s the perfect time to do so. In this edition of the blog, I’ll highlight some of the major forces that defined 2025 and explore the opportunities and challenges investors may face in 2026.

For the sixth time in the past seven years, the stock market is on pace to deliver double‑digit gains. The only interruption in this streak came in 2022, when inflation briefly derailed momentum. Overall, this run has obviously left many of you in a stronger financial position.

It’s often said that anticipation can feel greater than reality. On one hand, investors welcome returns like these — they directly support portfolios and long‑term goals. On the other, once markets climb to near record highs, nerves can set in. With valuations approaching levels last seen during the dot‑com era, it’s natural to wonder how long the rally can last.

2025 in Review

This past year brought turning points across several issues that had weighed on investors:

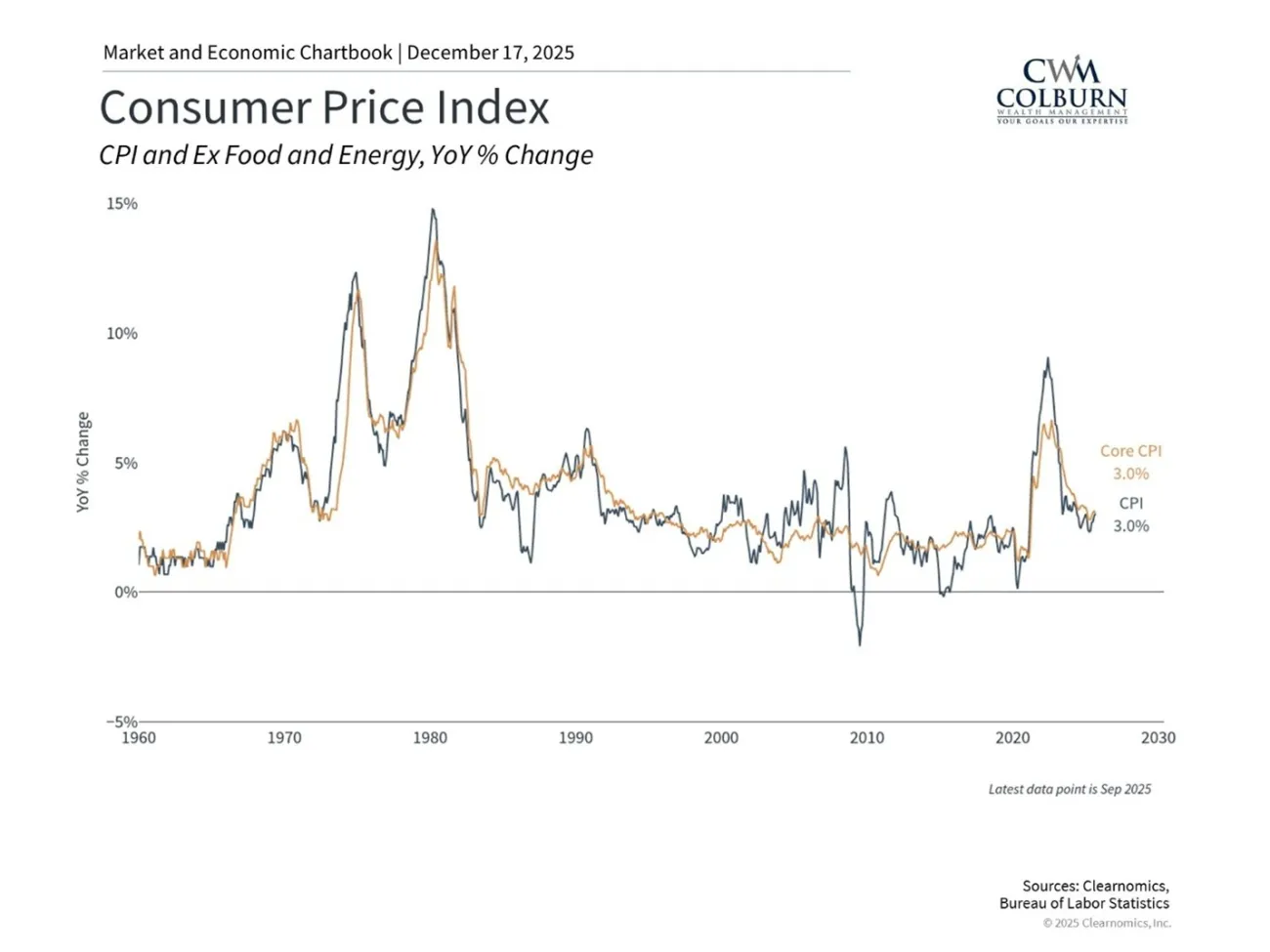

- Inflation stabilized around 3%, still noticeable for households but far less disruptive.

- Tariffs, though high by historical standards and a driver of market swings, did not trigger the feared economic fallout.

- The Federal Reserve continued cutting rates, supporting a healthy pace of economic growth.

The broader lesson? What investors fear most often doesn’t materialize. The recession predicted since 2022 never arrived. History shows that while genuine disruptions occur — the 2008 financial crisis or the 2020 pandemic — many anticipated disruptive events never come to pass. The challenge for long‑term investors is not predicting every twist, but maintaining discipline and perspective through all conditions.

Looking Ahead to 2026

The coming year will bring both opportunities and challenges. Expect headlines around the midterm elections, a leadership change at the Federal Reserve, the future of AI, concerns about loan markets, and the path of the U.S. dollar. Again, what matters most is not forecasting each event, but ensuring portfolios are built to withstand inevitable uncertainty while continuing to capture long‑term growth.

Here are seven themes shaping the year ahead:

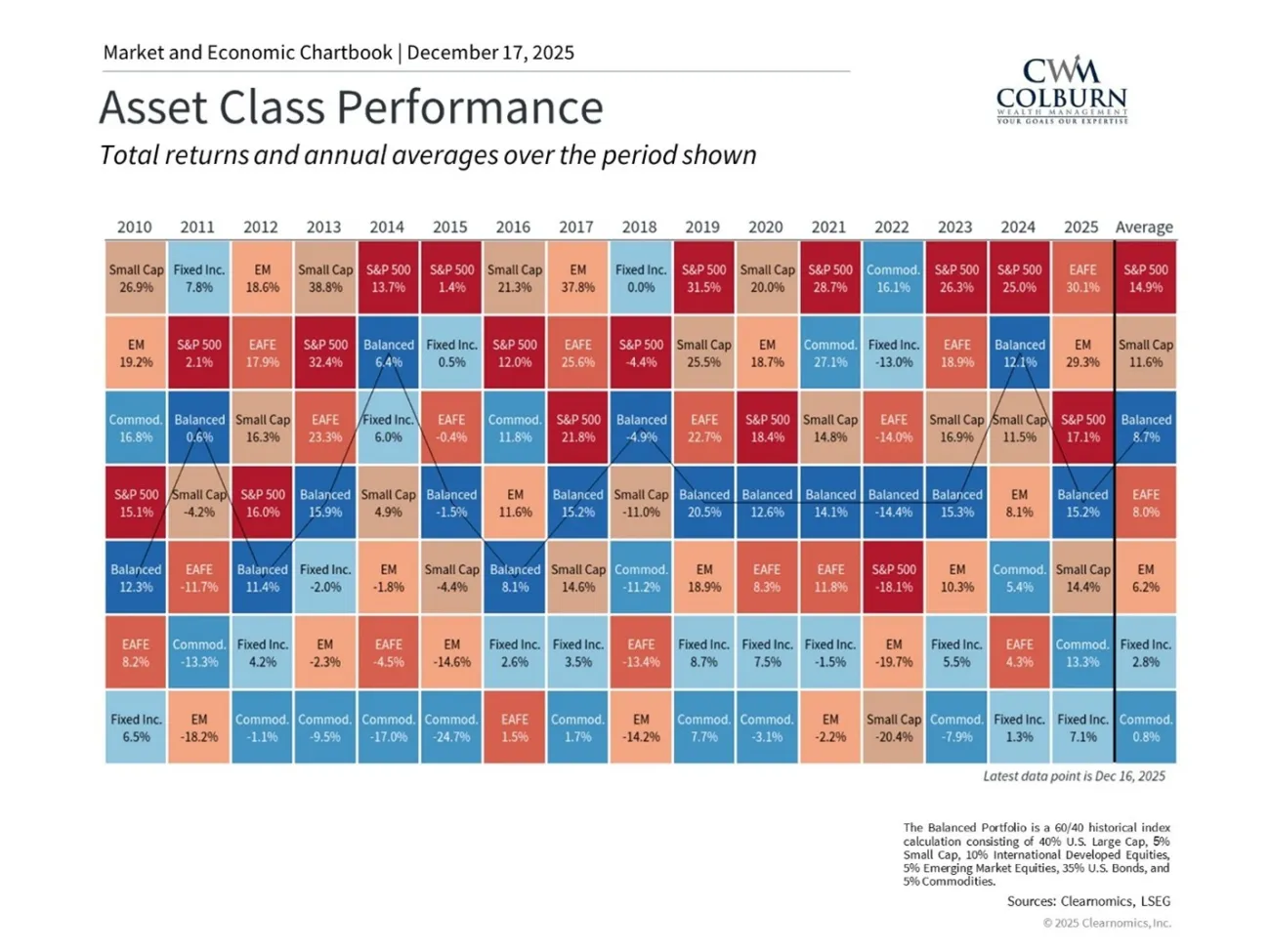

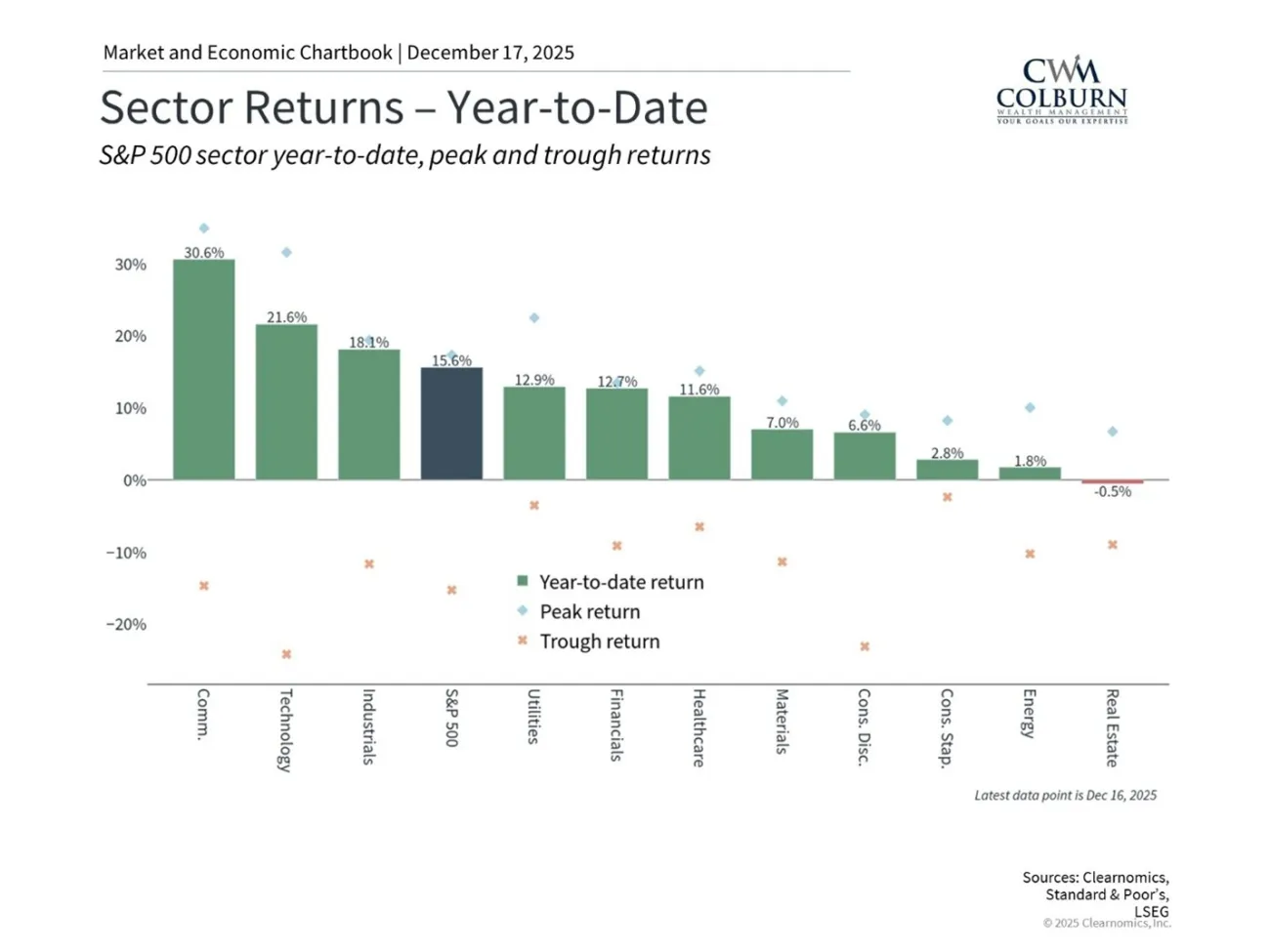

1. Multiple Asset Classes Are Contributing

Unlike much of the past decade, when U.S. stocks dominated, 2025 saw international markets outpace the U.S.:

- Developed markets (MSCI EAFE) and emerging markets (MSCI EM) each gained ~30% in U.S. dollar terms YTD, driven by stronger growth expectations and a weaker dollar.

- Fixed income also played its role, with the Bloomberg U.S. Aggregate Bond Index up ~7% YTD as rate cuts and stable inflation supported higher‑quality bonds.

The takeaway: balance and diversification matter more than chasing headlines. Investors who stay aligned with their financial plans are best positioned to benefit.

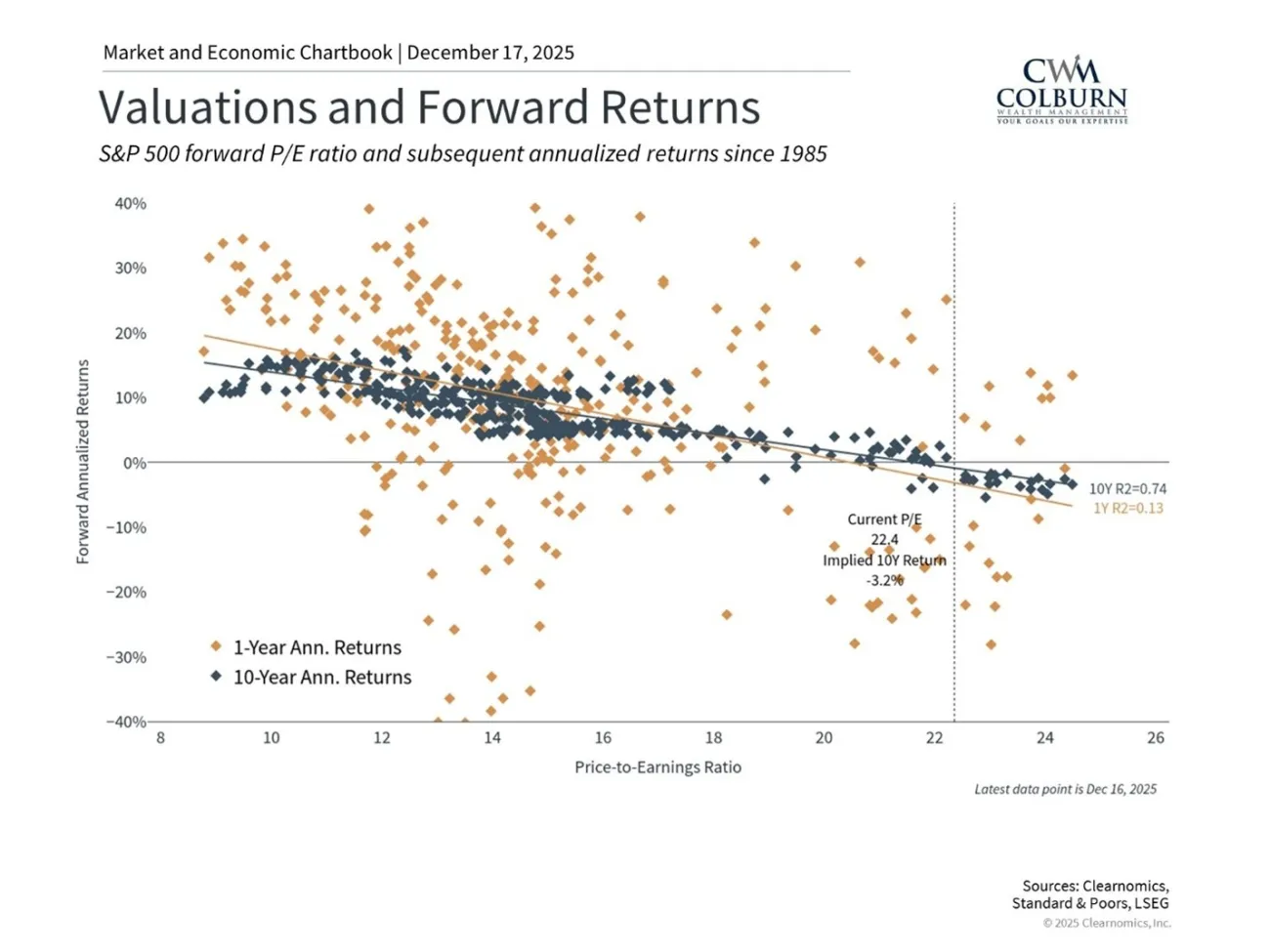

2. Valuations Near Dot‑Com Levels

Strong returns have pushed valuations higher:

- The S&P 500 trades at ~22.5x earnings, close to the dot‑com peak of 24.5x.

- While expensive, today’s valuations are supported by solid fundamentals. Earnings have grown at a healthy pace, with consensus estimates pointing to continued strength (LSEG data).

High valuations don’t guarantee a downturn — markets can remain expensive for years. But they do suggest a potential for more modest returns ahead and greater sensitivity to disappointments. In markets “priced for perfection,” even small misses can spark volatility. Selectivity and balance across asset classes, sectors, and styles will be increasingly important.

3. AI as a Growth Driver

No trend has captured investor attention more than artificial intelligence. In 2025, capital spending on AI infrastructure reached trillions of dollars — from data centers and GPUs to research talent. Some deals even appear circular, such as Nvidia investing $100 billion in OpenAI, which in turn buys millions of Nvidia chips.

Adoption is accelerating:

- Businesses reporting significant AI use rose from 4% in Sept 2023 to 10% in Sept 2025.

- Those anticipating adoption within six months jumped from 6% to 14% over the same period (Census Bureau survey).

The upside is clear, but risks remain. The “Magnificent 7” tech giants now represent one‑third of the S&P 500, creating concentration risk. History shows transformative technologies often take longer to generate profits than markets expect. Investors should recognize their likely exposure to AI — directly or through indices — and maintain allocations aligned with long‑term goals.

4. Economic Growth Appears to Be Slowing but Remains Positive

Growth has cooled slightly but remains stronger than feared. U.S. GDP dipped slightly in Q1 2025, then rebounded with 3.8% growth in Q2 — one of the strongest quarterly rates in years.

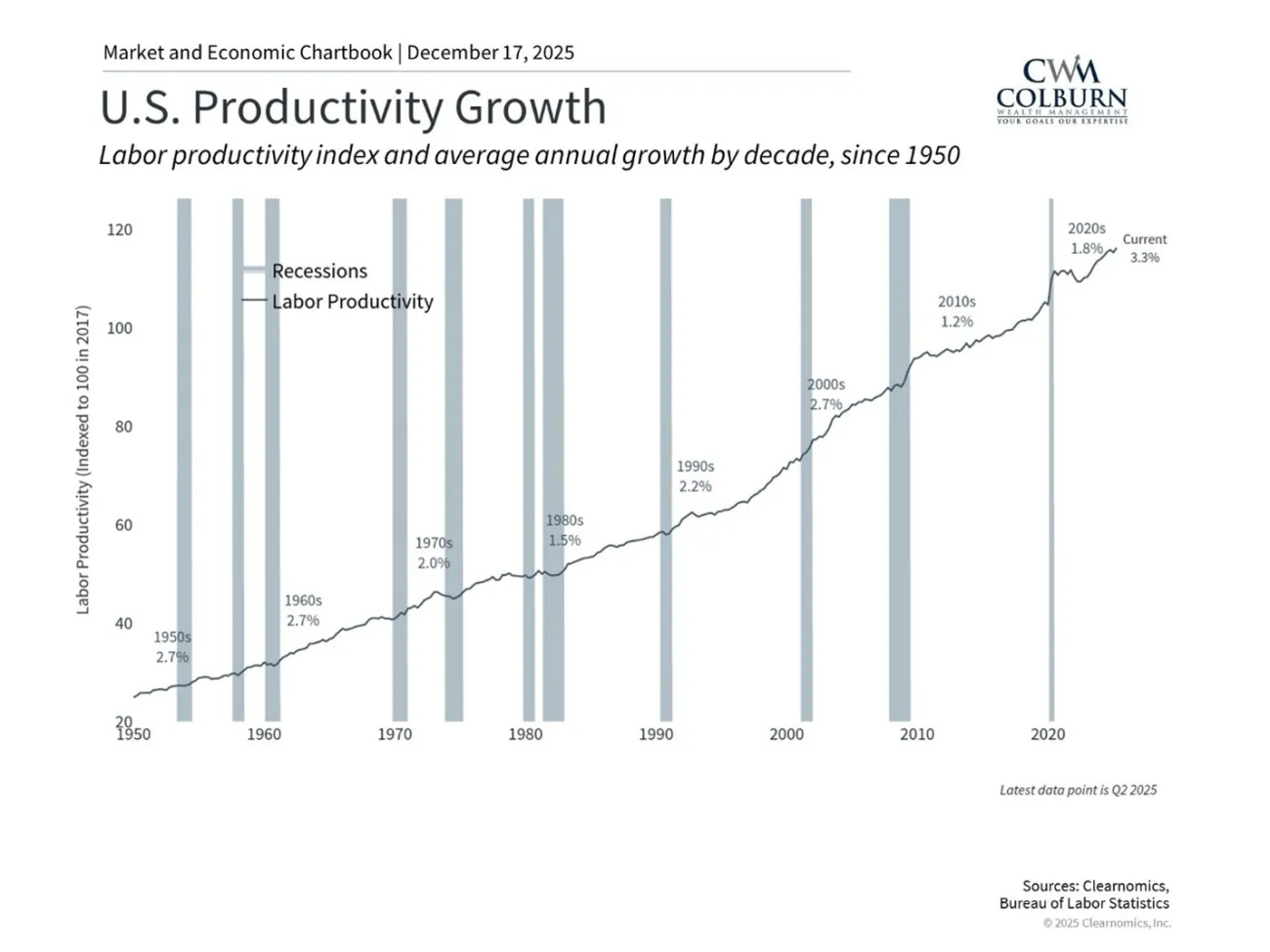

The “two‑speed” or “K‑shaped” economy reflects uneven benefits. AI‑driven industries are thriving, while consumer debt and auto loan delinquencies weigh on others. One key question is whether productivity will rise. Historically, productivity averaged only 1.2% per year in the 2010s. AI may eventually boost output, but such gains might take longer than expected.

Globally, the IMF projects GDP to ease from 3.2% in 2024 to 3.1% in 2026. Advanced economies may grow around 1.5%, while emerging markets maintain growth above 4%.

5. Tariff Impacts Remain Uncertain

Tariffs, in large part, drove volatility in 2025, yet their economic effects have been muted. Despite costs rising compared to prior years, inflation measures like the CPI ticked up only slightly.

Possible reasons:

- Many tariffs were paused or scaled back.

- Companies absorbed costs or imported goods ahead of announcements.

- Strong consumer spending and AI‑related growth offset negatives.

Tariffs now may be a recurring policy tool. While they aren’t disappearing, their day‑to‑day impact on markets have seemingly faded.

6. Midterm Elections and Debt Concerns

2025 saw a 43‑day government shutdown and ongoing deficit worries. The One Big Beautiful Bill Act (OBBBA) provided clarity, including provisions like full R&D expensing.

Looking ahead:

- Another funding deadline looms in January 2026.

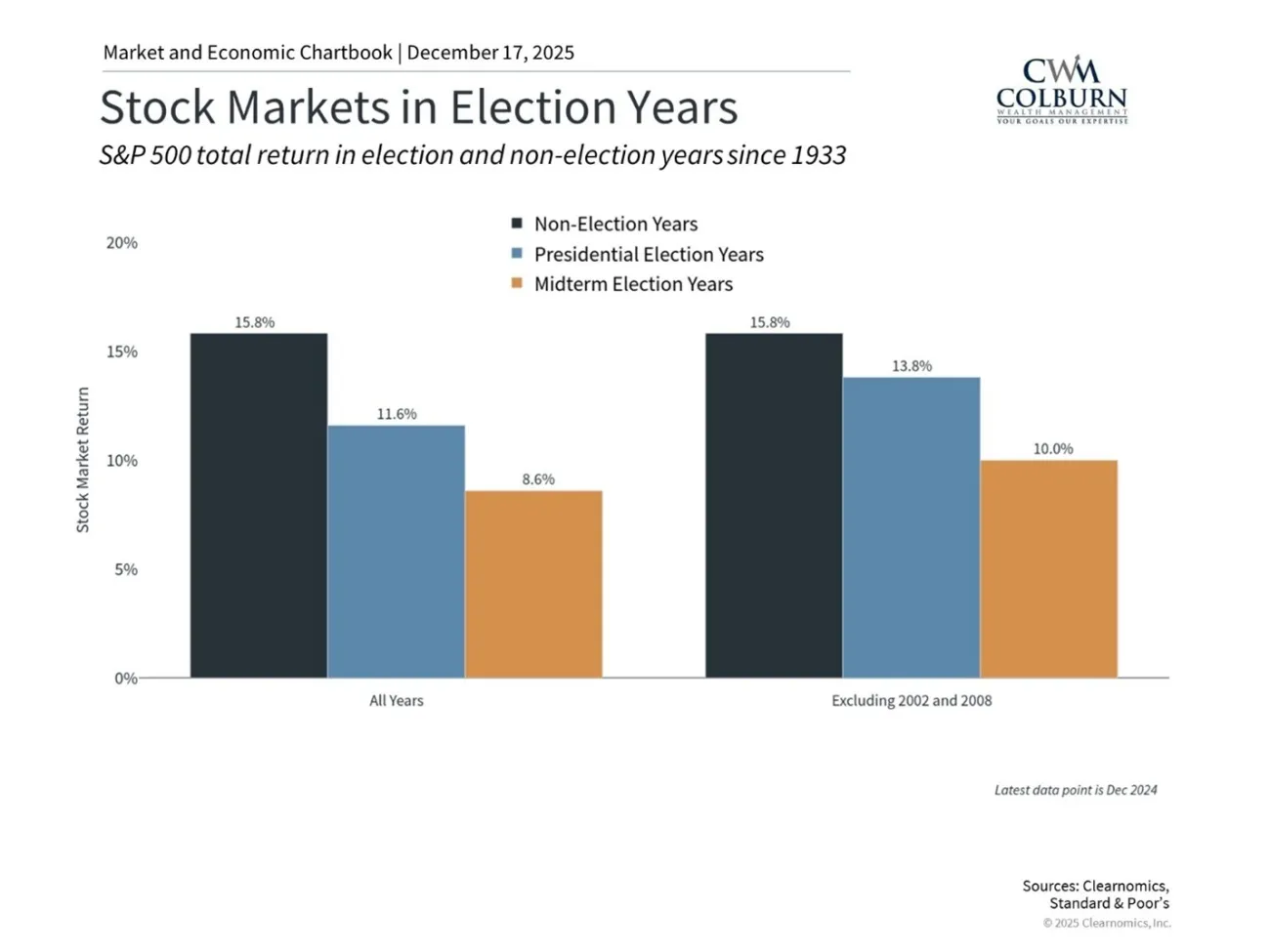

- Midterm elections will likely shape tariffs, regulation, and spending. Historically, midterm years have averaged 8.6% market returns since 1933.

- The national debt is likely to remain a headline topic. It now stands at 120% of GDP, over $36 trillion, or roughly $106,000 per American.

For investors, the lesson is to focus on controllable factors — such as tax strategy — rather than trying to position portfolios around debt headlines.

7. The Federal Reserve’s Role

The Fed resumed rate cuts in September 2025. As 2026 begins, policy may shift focus from inflation to a weaker job market.

Complicating matters, Chair Jerome Powell’s term ends May 15, 2026, with new leadership expected to favor lower rates. Still, history shows the economy has performed well under Fed Chairs from both parties.

Remember: the Fed controls short‑term rates, but long‑term yields depend on growth, inflation, and productivity. Investors should focus on these broader drivers rather than every Fed statement.

Maintaining Perspective in 2026

As we enter 2026, investors face a familiar challenge: balancing concerns with the reality that markets have consistently rewarded patient, disciplined investors over time. For every genuine crisis, many more feared events never materialize. Success lies not in predicting which risks matter most, but in staying balanced through all phases of the market cycle.

Take care and, as always, stay the course.

Colburn Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.